Industrial Software Expertise for Technology Investors

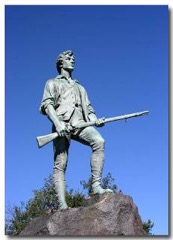

Minutemen provided a highly-trained, rapidly-deployed force that were able to respond immediately to military threats and were among the first called to duty.

We help private equity investors quickly acquire, accelerate, and scale industrial software companies, from due diligence to boardroom impact.

Core Offerings

Commercial Due Diligence Support:

Supplement market mapping, competitive benchmarking, customer validation, product/tech assessments, investment thesis vetting, and M&A target lists. Supplement deal team with in-market experience to add credibilty in management presentations.

Post-Close Operating Advisory:

90-day acceleration plans, GTM refinement, M&A strategy and execution, leadership alignment, interim C-suite support.

Board & Advisory Roles:

Ongoing idependent operating partner-like board presence with proven industrial software track record of driving growth, creating value and orchestrating successful exits.

Who we work with

Private Equity Investors

Independent, credible insight for faster, better investment decisions.

Venture Capital Firms

Deep market validation for early and growth-stage deals.

Management Teams

Post-close acceleration, strategic GTM, and operational oversight.

Commercial Due Diligence Consultants

Supplement your team with domain-experienced SMEs. Skip the expert network calls

Why Clients Choose Minuteman Advisory Partners

Specialized Niche

Years inside the industrial software and B2B SaaS ecosystem.

Operator’s Perspective

Built, scaled, and exited technology businesses.

Investor-Focused

Think like deal partners, act like operators; not consultants.